How Reliance Jio Disrupted the Indian Telecom Market in Record Time

Photo by Muntazir Abbas

How Reliance Jio Disrupted the Indian Telecom Market in Record Time

Before Reliance Jio’s entry in September 2016, India’s telecom sector was dominated by legacy players such as Bharti Airtel, Vodafone, and Idea, which primarily generated revenue from voice calls and charged relatively high data prices. Internet penetration was low, especially in rural regions, and the quality of data services varied widely. Mobile data was often treated as an expensive add-on, with many users still relying on 2G and early 3G networks. This left a gap between demand for affordable broadband and what incumbents offered.

Against this backdrop, Reliance Jio Infocomm Ltd. — a subsidiary of Reliance Industries Ltd. (RIL) — entered the market with a bold vision: to democratize access to high-speed mobile internet for all Indians and accelerate the country’s digital transformation. It achieved this in record time, reshaping the competitive landscape and permanently altering consumer expectations.

Pricing Strategy: Redefining Cost Structures and Market Norms

1. Aggressive Launch Offers

Jio’s pricing strategy was transformational, not merely competitive. Its initial “Welcome Offer” and subsequent “Happy New Year Offer” provided:

- Free 4G data, unlimited voice calls, and free SMS

- Zero financial risk to consumers

- A rich suite of bundled digital services (e.g., JioCinema, JioTV, JioSaavn) at no cost during the period

These offers eliminated the adoption barrier, triggered mass trial, and created habit formation among subscribers. Within months, millions of users had migrated to Jio’s network.

2. Market Restructuring Through Pricing

When the free phase ended in early 2017, Jio didn’t simply revert to typical tariffs; it reset the entire pricing structure:

- Data plans were approximately 90 % cheaper than incumbents’ offerings

- Voice calls remained free indefinitely

- Tariffs like ₹149 for a daily high-speed plan became benchmarks

This forced rivals to slash their prices drastically — a price war that eroded their revenues and margins. Operators such as Airtel and Vodafone-Idea reduced data costs and offered free voice to retain customers.

3. Consumer Impact

Jio’s pricing revolution had far-reaching consequences:

- Cost per gigabyte in India dropped from ~₹200-₹300 pre-Jio to single-digit levels within a few years.

- Average Revenue Per User (ARPU) industry-wide declined sharply as expectations shifted toward low-cost data and unlimited voice.

- Unlimited calling became a standard offering, eroding a core revenue stream for incumbents.

This pricing strategy didn’t just capture market share — it expanded the total market by making data affordable for millions who had never used mobile broadband.

Infrastructure Investment: Building a Digital Backbone

1. Greenfield 4G-Only Network

Unlike existing operators forced to maintain fragmented 2G and 3G networks, Jio launched a pure 4G LTE network across India from day one. It deployed VoLTE (Voice over LTE) as the sole voice solution, eliminating legacy voice networks entirely.

This decision had multiple strategic advantages:

- Simplified operations: A single technology meant lower complexity and higher network efficiency.

- Cost advantage: Avoiding older technologies reduced operational expenses.

- Future-proofing: The network was ready for data-driven growth from the outset.

2. Massive Capital Deployment

Reliance invested massive capital into building Jio’s infrastructure:

- Over ₹1.5 lakh crore (about ~$23 billion) in network build-out before commercial launch.

- Thousands of kilometres of fiber optic backbone, making Jio one of the largest such networks in the world.

- Extensive tower deployments and spectrum acquisitions across multiple bands.

This scale of investment created a barrier to entry that few competitors could match, and it allowed Jio to absorb losses during early years without undue financial stress.

3. Technology Efficiencies

VoLTE reduced costs by carrying both voice and data over the same network, eliminating the expenses of maintaining separate systems. An all-IP architecture ensured scalability and agility as data demand grew.

Rapid Mass Adoption: From Zero to Scale in Record Time

Jio’s customer acquisition was phenomenal:

- It amassed millions of subscribers within months of launch, reaching about 100 million in roughly six months.

- By 2019, Jio had an estimated 340 million subscribers and was among the largest operators in India.

This adoption pace was facilitated by:

- Minimal entry barriers: free initial services and low-cost devices like the JioPhone, which bridged the smartphone gap for many users.

- Widespread distribution: home delivery of SIMs, eKYC, multilingual campaigns, and retail reach.

- Mass appeal: Data-centric offerings resonated with India’s young, mobile-first population.

As a result, India rapidly became one of the world’s largest data consumption markets, with average data usage rising sharply across the user base — a testament to how affordability and speed drove engagement.

Ecosystem Thinking: Beyond Connectivity

Jio’s strategy was not limited to telecom connectivity. It built a digital ecosystem designed to increase user engagement and create new revenue avenues.

1. Digital Services Suite

Jio bundled a range of digital services — from streaming (JioCinema) to music (JioSaavn) and TV (JioTV). These services:

- Increased data consumption, boosting network usage.

- Created ecosystems that kept users engaged within Jio’s platforms.

- Positioned Jio beyond a “telco” into a **digital lifestyle brand”.

2. Broader Integration

Jio’s ambitions extended into:

- Fixed broadband via JioFiber

- Smart devices like JioPhone Next and affordable 4G feature phones.

- Partnerships with global tech players (Google, Meta, Microsoft) that enriched the ecosystem and brought in capital.

This ecosystem strategy enhanced user stickiness and diversified revenue streams beyond core voice/data connectivity.

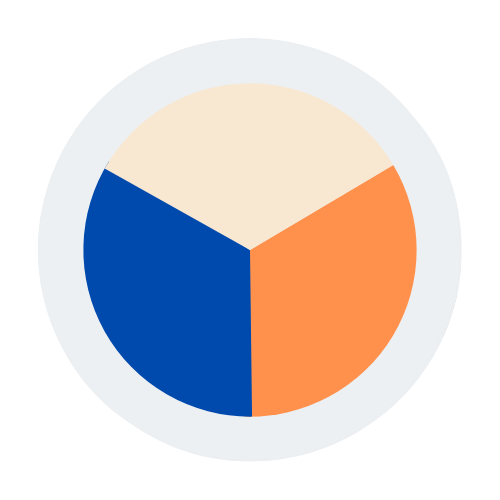

Market Restructuring and Competitive Outcomes

Jio’s entry triggered a wave of consolidation and restructuring:

- Smaller operators like Aircel, Tata, and MTS exited the market.

- Vodafone and Idea merged to form Vodafone Idea in response to competitive pressures.

- Remaining players had to invest heavily in 4G and later 5G to stay relevant.

The industry structure consolidated from 10+ players to essentially three major ones, with Jio among the leaders. This consolidation reflected the high-capex nature of telecom and how capital-intensive disruption can reshape competitive landscapes.

Conclusion: A Blueprint for Disruptive Innovation

Reliance Jio’s rise was unprecedented in scale and speed. Its disruption was enabled by:

- A radical pricing strategy that reset consumer expectations and compressed industry tariffs.

- Massive infrastructure investment that created a modern, efficient network capable of meeting exploding data demand.

- Strategies that fueled rapid mass adoption, even in previously underserved markets.

- Ecosystem thinking that extended the value proposition beyond connectivity into digital lifestyles.

Jio’s playbook — combining financial heft with bold pricing, technological leapfrogging, and ecosystem development — offers a powerful example of how a well-executed strategy can transform a legacy industry and drive inclusive digital growth. Through this disruption, Jio didn’t just capture market share — it expanded the market, reshaped consumer behavior, and significantly accelerated India’s digital journey.