What do we learn from Rich Dad Poor Dad by Robert kyoski ?

“Rich Dad Poor Dad” by Robert Kiyosaki is a personal finance and self-help book that offers valuable lessons and perspectives on wealth creation and financial literacy. Here are some key takeaways from the book:

The Importance of Financial Education: Kiyosaki emphasizes the significance of financial education, stating that traditional schooling often fails to teach essential money management skills. He encourages readers to seek financial knowledge and develop a mindset focused on acquiring assets that generate income.

Differentiating Assets and Liabilities: The book introduces the concept of distinguishing between assets and liabilities. Assets are defined as things that generate income, while liabilities are expenses that reduce wealth. Understanding this distinction is crucial for building wealth and achieving financial independence.

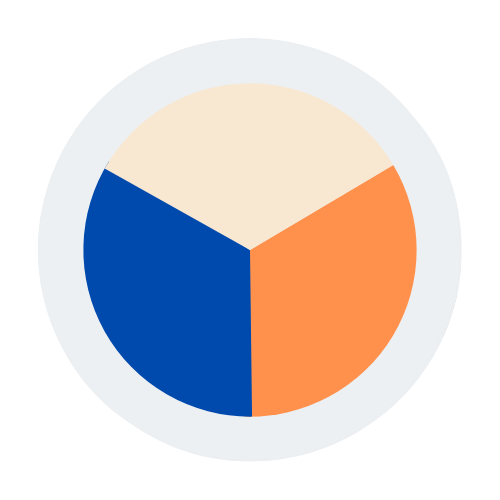

The Cash Flow Quadrant: Kiyosaki introduces the Cash Flow Quadrant, which categorizes individuals into four quadrants based on their income source: Employee, Self-Employed, Business Owner, and Investor. The book encourages moving from the left side (Employee and Self-Employed) to the right side (Business Owner and Investor) to achieve financial freedom and wealth creation.

The Power of Passive Income: Kiyosaki emphasizes the importance of generating passive income, which is income earned without actively trading time for money. Building businesses, investments, or real estate properties that generate passive income is seen as a key strategy for achieving financial independence.

Mindset and Risk-Taking: The book emphasizes the importance of cultivating an entrepreneurial mindset, being open to taking calculated risks, and learning from failures. Kiyosaki encourages readers to overcome fear and adopt a proactive approach to wealth creation.

Critique of Conventional Financial Advice: Kiyosaki challenges conventional financial wisdom, such as the focus on job security, reliance on a single source of income, and excessive debt. He encourages readers to think critically about financial decisions and challenge societal norms regarding money.

Wealth Building through Assets: “Rich Dad Poor Dad” stresses the significance of accumulating income-generating assets such as real estate, stocks, businesses, and intellectual property. The book suggests focusing on acquiring assets that appreciate in value and generate cash flow to build long-term wealth.

Financial Independence: The ultimate goal presented in the book is achieving financial independence, where your passive income exceeds your expenses. This allows individuals to have more control over their time and pursue their passions and interests.

It’s important to note that while “Rich Dad Poor Dad” has been widely read and resonated with many readers, it has also received some criticism and debate regarding certain concepts and the author’s personal experiences. It’s recommended to approach the book with an open mind, critically evaluate the ideas presented, and adapt them to your own financial situation and goals.